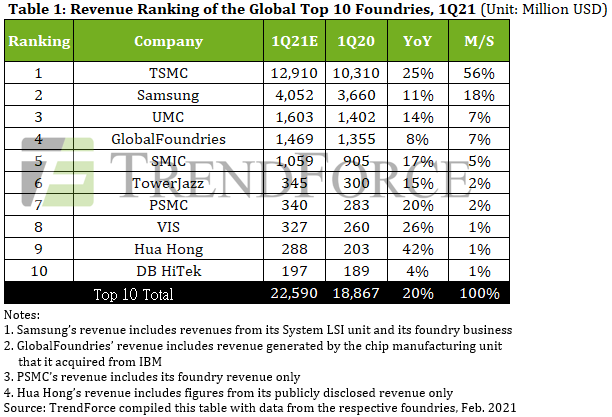

5nm wafer inputs are projected to account for 20% TSMC’s Q1 revenue.

7nm revenue, driven by demand from AMD, Nvidia, Qualcomm, and MediaTek, will account for 30% of TSMC’s Q1 revenue.

Overall, TSMC’s revenue is expected to rise 25% increase YoY in 1Q21 on the back of demand for 5G, HPC, and automotive applications.

As a result of demand for 5G chips, CIS, driver ICs, and HPC chips, Samsung’s capacity utilisation rates for the 5nm and 7nm nodes have been relatively high in 1Q21, and revenue is expected to be up 11% YoY.

UMC is expected grow revenues 14% YoY in Q1.

GlobalFoundries’ revenue is expected to increase by 8% YoY in 1Q21.

SMIC’s revenue for the 14nm and below nodes is expected to decline in 1Q21 but the market for 40nm and above processes is expected to deliver a 17% increase.

TowerJazz’s Q1 revenue is expected to be flat with Q4 but up 15% YoY.

PSMC is primarily focused on manufacturing memory products, DDICs, CIS, and PMICs. At the moment, high demand for 8-inch and 12-inch wafer capacities and for automotive chips has resulted in fully loaded capacity for PSMC. The company’s revenue is expected to increase by 20% YoY in 1Q21.

VIS’ capacity is fully loaded across all of its process technologies. Driven by increased spec requirements for PMICs and small-sized DDICs, VIS’ revenue is expected to increase by 26% YoY in 1Q21.

Hua Hong is currently placing considerable emphasis on expanding the 12-inch capacity of HH Fab7 in Wuxi. Process technologies for 12-inch production lines, including NOR, BCD, Super Junction, and IGBT, have all passed qualifications. , thereby injecting fresh momentum into Hua Hong’s development. Hua Hong’s revenue may likely reach a 42% YoY increase in 1Q21.

from:electronicsweekly